Sustainability Platforms Benchmark 2023:

Who are the “best in class” platform providers in Europe?

- Manufacturers Are Urged to Embrace Sustainability: PAC highlights the imperative for manufacturers to integrate sustainability across all divisions in response to EU directives.

- A Diverse Vendor Landscape: Vendors from different backgrounds and with varied specialities are competing for shares in the evolving market for environmental sustainability solutions.

- Rapid Growth of the Sustainability Software Market: Despite its current size, PAC believes that software and IT services related to environmental sustainability will grow fast in the coming years. Projected growth for Germany, for instance, is 37.7% in 2024, which reflects strategic investments and potential market shifts.

Munich, January 10, 2023 | The European analyst firm PAC (Pierre Audoin Consultants) has again looked at the providers of open digital platforms for the manufacturing industry. This time, 94 platform vendors active in the European market were reviewed across 9 topics. The focus of the INNOVATION RADAR has always been to differentiate between different platform concepts and evaluate newly emerging topics, one of them being sustainability.

The necessity to become more sustainable

Environmental sustainability is not a new topic. For decades, politicians and scientists have been discussing this subject, and international treaties such as the Kyoto Protocol of 1992 have certainly helped reduce greenhouse gas (GHG) emissions and slow global warming. However, the 2000s have shown that these initiatives were not enough. As consumers (especially the younger generations) are demanding more efforts to stop man-made climate change, the European Union has been adopting policies that support more sustainable business and consumption models. A year ago, the Corporate Sustainability Reporting Directive (CSRD) came into effect, and in late 2023, the European Parliament also approved the Corporate Sustainability Due Diligence Directive (CSDDD). Both are setting new standards that business leaders from all industries, including the manufacturing sector, must adopt.

To do so, manufacturers need the right tools to collect and analyse data on their environmental impact across all units. Companies do understand that sustainability cannot just be dealt with by a single department; instead, it is a principle that must be adopted and integrated across all divisions. This is also true for senior management, where PAC observes companies just hiring candidates with the necessary expertise and appointing Chief Sustainability Officers (CSO) instead of assigning sustainability to another C-level executive, like the CFO or CMO.

“Manufacturers cannot ignore sustainability any longer. With the (upcoming) EU regulations, they not only have a regulatory obligation; it will also be easier to draw comparisons with competitors, i.e., their image, reputation, and competitive advantage may increasingly be at risk.”

The provider landscape

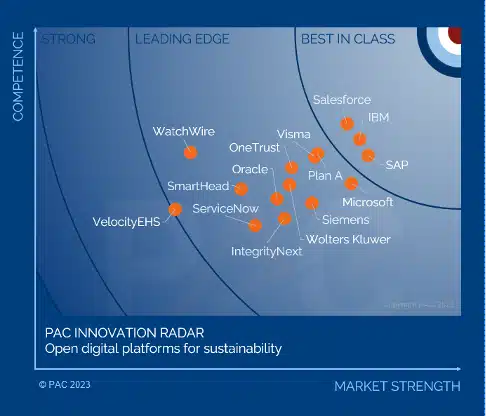

In the INNOVATION RADAR, PAC looked at companies with activities in Europe, including them in the evaluation if their platforms helped manufacturers with at least one of the following topics: carbon accounting, sustainability reporting, or applying principles of the circular economy. A total of 15 companies were analysed according to more than 30 criteria related to market strength and competence.

IBM, Salesforce, and SAP achieved the highest scores in the INNOVATION RADAR. They all come from different backgrounds. Overall, PAC classified the considered providers in five categories. Salesforce and SAP belong to the typical business application providers, along with vendors like Microsoft, Oracle, and ServiceNow. These players are known for their solutions covering ERP, CRM, and other processes; they have made significant investments to improve their capabilities in sustainability. Then there are the sustainability specialists, such as Plan A, SmartHead, and WatchWire. These companies have always focused on sustainability (or even ESG) and have acquired deep expertise but have less market power than Salesforce and SAP. The next category is vendors like OneTrust and IntegrityNext, which are experts in governance, risk, and compliance and consider environmental sustainability as adjacent to these topics. Next, there are the CAD and PLM specialists, like Siemens. They have strong industry expertise and often focus on product carbon footprints (PCF), thereby also dealing with product design. The last group includes players such as IBM, Wolters Kluwer, and Visma who prefer to grow their sustainability business units by acquiring specialists (Envizi, Enablon, and SmartTrackers, respectively) and integrating and improving their sustainability offerings with the acquired capabilities.

A market on the move

The landscape of platform providers for environmental sustainability as a whole is highly dynamic. According to PAC’s analysis, the market is still small, worth only about €590 million in Germany (vs. €42 billion for the entire German software & cloud platforms market). Nonetheless, the software & cloud platforms segment for environmental sustainability has the highest growth rate. PAC estimates that in 2024, the market will grow by 37.7% in Germany and will continue its strong expansion in the years to come.

Given such impressive potential, it is not surprising that platform vendors have been quick to make investments to grab a piece of the cake and secure a leadership position for themselves in the market. As mentioned before, some software vendors have organically grown their sustainability know-how, while others have acquired some specialists, merging deep expertise with substantial market power.

What about the other sustainability specialists? The assessment is mixed. Some companies seem well on their way to establishing themselves as benchmark players. Plan A is a very good example: specializing in carbon accounting software for all 3 scopes, the company has been able to raise $40 million in funding since its creation in 2017 and has prominent clients such as BMW, Flixbus, Société Générale, and the European Union. Some sustainability experts join forces to increase their market footprint; VERSO, sustainably, and Silvester Group, for instance, merged into one company under the name of VERSO. Other companies with interesting capabilities in environmental sustainability are acquired by more established vendors. Zeigo, for instance, the British provider of a supply chain decarbonization platform, was acquired by Schneider Electric.

“Some of the biggest challenges for manufacturers are to sustainably manage the supply chain and scope 3 emissions as well as implement circularity. The former topic is addressed by many software vendors, while the latter topic is currently less of a priority.”

All in all, IT user companies still consider sustainability as a concept that they integrate because they have to. Meeting the requirements of regulators, consumers, and employees is what makes this topic so relevant for the software & IT services industry. The PAC INNOVATION RADAR on Open Digital Platforms has identified many of the market drivers dominating the topic in 2023, especially in the manufacturing industry. The considerable dynamic and fragmentation of the market lead PAC to believe that the picture will change over the coming months.